boulder co sales tax efile

Saturday May 7 2022. You can print a 8845 sales tax table here.

Five Areas Of Focus For Tax Teams As They Look To A Post Covid Future Ey Taiwan

With proof of payment sales tax paid to another tax jurisdiction may be credited against consumer use tax due for a particular item.

. In 2001 the voters of Boulder County passed a ballot issue that allowed for a 01 percent one cent on a 10 purchase countywide transportation sales tax. If you cant find what youre looking for online contact Sales Tax staff at salestaxbouldercoloradogov. Colorado Tax Lookup Tool.

Office of Financial Management. Businesses with a sales tax liability of up to 15month or 180year. This is the total of state county and city sales tax rates.

The Boulder sales tax rate is. Visit the Boulder Online Tax System Help Center for additional resources and guidance. The Colorado state sales tax rate is currently.

The Transportation Sales Tax helps fund. Boulder County enacts Stage 1 fire restrictions News release. Monthly returns are due the 20th day of month following reporting period.

Between 2009 and 2019 sales tax revenues in the city had steadily increased with the exception of a flattening between 2016 and 2017. Kailee Nicole Foerster 2338 14th Street Unit 2 Boulder CO 80304 949-409-5911. Businesses located in the Center Fee districts sales tax rate is 175 and is in addition to the district fees.

General Tax Information Booklet PDF 1015KB is intended to provide general tax information for anyone conducting business in the City and County of Denver. 2022 City of Boulder. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online.

Property Data. File online tax returns with electronic payment options. The 2018 United States Supreme Court decision in South Dakota v.

Filing of the return is required for all. The City of Lovelands sales tax rate is 30 combined with Latimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670. Of a permitted construction project to determine whether there was an overpayment or underpayment of Construction Use Tax.

Businesses that pay more than 75000 per year in state sales tax. Beginning July 1 2022 retailers must collect a 027 retail delivery fee on every retail sale delivered by motor vehicle to a location within Colorado. If you have more than one business location you must file a separate return in Revenue Online for each location.

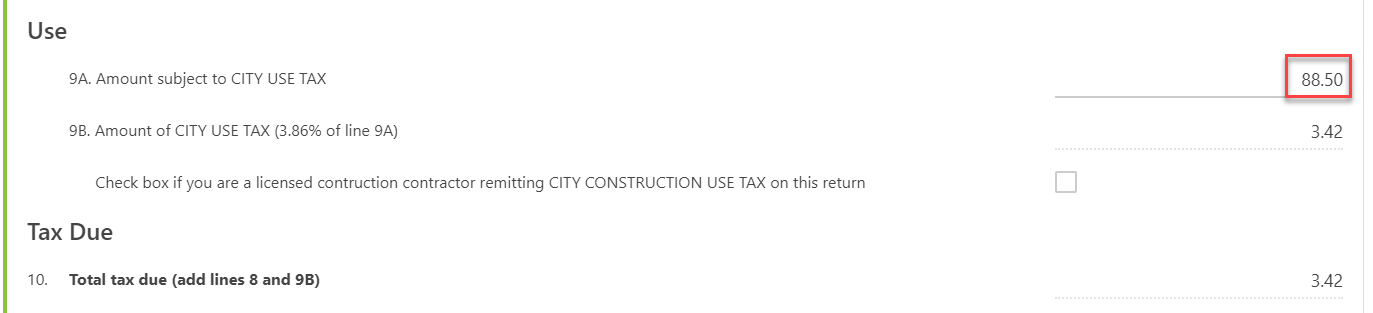

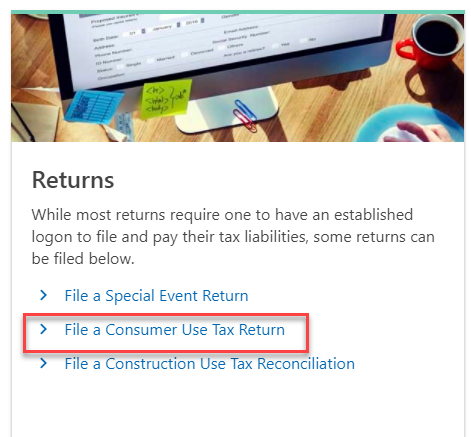

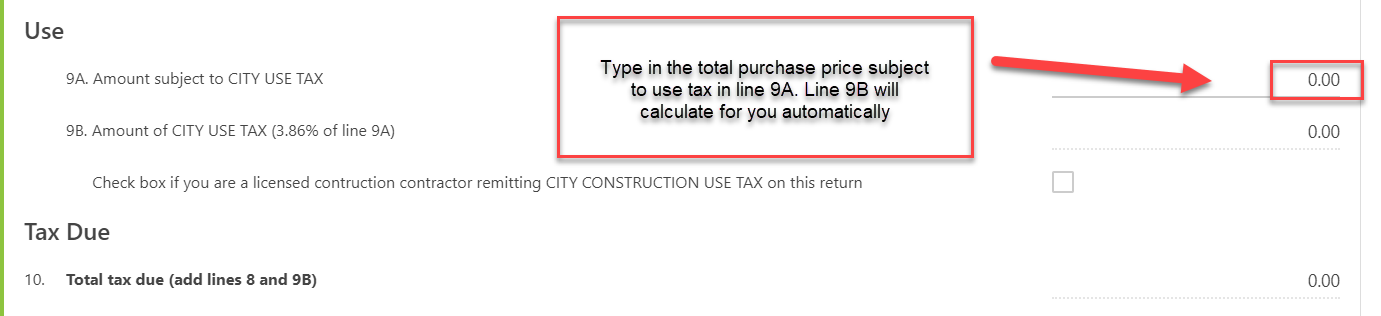

This is the total of state and county sales tax rates. Consumer Use Tax How To File Online Department Of Revenue Taxation. In 2007 voters approved an extension of the sales tax through 2024.

The City and County of Denver. The Boulder County sales tax rate is. For tax rates in other cities see Colorado sales taxes by city and county.

The Boulder Online Tax System offers enhanced user experiences and tax compliance functionality to city businesses including the ability to. Return and payment due on or before January 20th each year. Recent Colorado statutory changes require retailers to charge collect and remit a new fee.

It provides information for collecting and filing sales use lodgers occupational privilege facilities development telecommunications and property taxes. Complete a Business License application or register for a Special Event License. Sent direct messages to Sales Tax Staff.

For additional e-file options for businesses with more than one location see Using an. Use Boulder Online Tax System to file a return and pay any tax due. Colorado Department of Revenue.

The COVID-19 pandemic resulted in significant business shut-downs in the final week of March 2020 and all of April 2020 and May 2020. Has impacted many state nexus laws and sales tax collection requirements. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax.

PO Box 471 Boulder CO 80306. Sales tax returns must be filed monthly. Construction Use Tax is the salesuse tax paid by contractors or homeowners for construction materials used when erecting building remodeling or repairing real property.

The County sales tax rate is. Use tax is intended to protect local businesses against unfair competition from out-of-city or state vendors who are not required to collect City of Boulder sales tax. 2020 13th Street Boulder CO 80302 Phone.

Boulder co sales tax efile. Businesses with a sales tax liability between 15-300 per month Return and payment due on or before the 20th of the month following the end of each quarter Monthly Filing. The Colorado sales tax rate is currently.

There are a few ways to e-file sales tax returns. 10 rows Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax. Online Sales Tax Filing.

The minimum combined 2022 sales tax rate for Boulder Colorado is. The minimum combined 2022 sales tax rate for Boulder County Colorado is. 300 or more per month.

The city use tax rate is the same as the sales tax rate. The Senior Tax Worker Program allows senior taxpayers to work in county offices to help pay their county taxes.

File Sales Tax Online Department Of Revenue Taxation

Tax Reform Faqs Top Questions About The New Tax Law Bdo

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

How To File Your Taxes As A Real Estate Agent Vaned

Tax Deadline Colorado Department Of Revenue Extends Income Tax Payment And Filing Deadline For Much Needed Relief

25 722 Irs Tax Images Stock Photos Vectors Shutterstock

Slow Tax Refunds Blamed For Taking Bite Out Of Restaurant Sales The Denver Post

Boulder Online Tax System Help Center City Of Boulder

Sales And Use Tax City Of Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

File Sales Tax Online Department Of Revenue Taxation

Sales Tax Campus Controller S Office University Of Colorado Boulder

National Candy Day November 4 National Candy Day Candy Gummy Candy